| | Financial Support from Chinese Government

Chinacables is a subsidiary of China National Machinery Industry

Corporation (SINOMACH), derived from the

Ministry of Machinery and Electric Industry of China. SINOMACH is a large scale,

state-owned enterprise group under the leadership of the State Assets

Supervision and Administration Commission. It have exported 70%

of power generation and transmission projects or equipments.

As the main company for China to export its heavy equipments and machinery for

power generation, transmission, telecommunication,

metallurgy, automobile, railway,

highway or road, China policy bank of China

Import-Export Bank will provide financial support to

Sinomach and its subsidiaries, including Chinacables,

for their projects in the foreign markets in these industries.

In order to widen Chinacables' business scopes,

it will cooperation with companies from Sinomach, such

as CMEC, to compete

in the world market for projects in power generation, transmission,

telecommunication, metallurgy,

automobile, railway, highway

or road or other projects which is eligible for Chinese government preferential

fund or loan support. According to China preferential

loan policy, policy banks will finance for

both Chinese export of mechanic and electronic products, complete

set of equipment, and high- and new-tech products and undertaking of

offshore construction contracts and overseas investment projects. Sinamach

and Chinacables, CMEC are eligible to apply these

loans and credits thanks to their technical, commercial

strength in the world construction market and their key status in China's

heavy machinery and equipment export section.

We usually provide three main financial supports for our projects in the

foreign countries upon sovereign guarantee, reputable

bank guarantee or other securities which are comfortable to us.

The three financial funds or credits are:

| Chinese government preferential concessional

loan |

| Export buyer's credit |

| Export Seller's Credit |

For details, please visit our China

Import-Export Bank website.

|

|

|

CHINESE GOVERNMENT CONCESSIONAL LOAN

|

|

|

|

Basic Concept

| Chinese Government Concessional Loan refers to the medium and

long-term, low interest rate credit extended by the China Eximbank

under the designation of the Chinese Government, to the Government of

the Borrowing Country with the nature of official assistance.

| The Export-Import Bank of China is authorized by the Chinese

Government as the sole lender of the Concessional Loan.

Objective

| Promote economic development and improve living standard in

developing countries

| Boost economic cooperation between developing countries and China

Resource and Utilization of Funds

| China Eximbank raises funds in domestic financial market through

bond issuing. Chinese Government subsidizes interest rate difference.

| The Loan is mainly used to procure mechanical and electronic

products, complete sets of equipment, high tech product, services as

well as materials from China.

Main project sectors

| infrastructure

Such as energy, transportation, telecommunication

| Industrial

Such as manufacturing, mining etc.

| Social welfare

Such as health-care, housing etc.

Basic Criteria for Project

| The project should be approved by both the Chinese Government and

the government of the Borrowing country

| The project should be technically feasible and can generate

favorable economic returns

| The project should have good social benefits

| Chinese enterprises should be selected as contractor/exporter

| Equipments, materials, technology or services needed for the project

should be procured from China ahead of other countries. In principle,

no less than 50% of the procurements shall come from China.

Terms and Conditions of Loan

| Loan Amount

In principle, the Loan amount should be no less than RMB 20 million

(approximately USD 2.4 million).

| Loan Currency

The loan is denominated in Renminbi Yuan

| Borrower

Borrower is normally the Government of the Borrowing Country

represented by Ministry of Finance

| Interest Rate and Maturity Period

Interest Rate and Maturity Period are Fixed by Chinese Government and

stipulated in inter-governmental framework agreement

| Maturity Period

Maturity Period includes Grace Period and Repayment Period

| Grace Period

In Grace Period, the borrower shall pay the interest but no principal

| Availability Period = Drawdown period

Borrower can make drawdown within Availability Period. The

Availability Period is included in the Grace Period and matches the

implementation period of the project.

| Interest payment

Interest is calculated and paid semi-annually. Interest collection

dates are fixed on March 21st and September 21st every year.

| Principal repayment

In repayment period, the principal is repaid semi-annually in equal

installments. Principal repayment dates are fixed on March 21st and

September 21st every year

| Management Fee

Management Fee is calculated on the basis of the total amount of the

Loan and paid in one lump sum before the first drawdown

| Commitment Fee

Commitment Fee is calculated on the basis of the undrawn amount of the

Loan and paid on interest collection dates

Project Cycle

1 Application

| Candidate project can be proposed to the Chinese Government or China

Eximbank by Borrowing country based on development plan and strategy

| Documents required

* Application

* The approval of the Government of the Borrowing country

* Feasibility study report: containing the objective, scope and

content of the project and detailed information on technical,

economical and social aspects.

* The commercial contract or other intention agreements.

* Brief introductions and financial statements of the project

executing agency and Chinese contractors/ exporters.

2 Appraisal

| China Eximbank conducts appraisal at its own discretion

| Reports results to the Chinese Government

| Following aspects are analyzed during appraisal

* Objective and necessity of the project

* Technical, financial, economical and social aspects of the project

* Macro-economic situation and debt servicing ability of the Borrowing

Country

* Management capability and financial strength of executing agency.

* Qualification and performance records of Chinese

contractor/exporter.

3 Agreement

| Inter-governmental Framework Agreement is signed by two

Governments, specifying purpose, amount, maturity period and interest

rate of the facility

| Loan Agreement is signed by China Eximbank and Borrower in

line with inter-governmental framework agreement

4 Implementation and Disbursement

| Borrower makes drawdown according to Loan Agreement

| Implementation is essentially the obligation of the Borrower and the

executing agency

| China Eximbank monitors the implementation to ensure the efficient

use of funds

| The Borrower reports to China Eximbank progress of project, use of

funds and provides necessary assistance

| After project is completed, the Borrower sends a completion report

to China Eximbank

5 Operating and Debt Servicing

| Executing Agency has the responsibility to operate the project.

China Eximbank may monitor the project and offer advice when it is

necessary.

| The Borrower has the obligation to pay interest and fees and repay

the principal according to the provision of Loan Agreement.

| After a period of operation, China Eximbank makes Ex-post evaluation

on the project on a case by case basis.

Disbursement Procedures

Contact Information

Concessional Loan Department

The Export-Import Bank of China

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

SELLER's CREDIT or Loans to Overseas Construction Contracts

|

|

|

Loans to Overseas Construction Contracts (the Loan) refer to the loans,

either in Renminbi or foreign currencies, that the Bank provides to

Chinese enterprises for financing their construction projects implemented

in foreign countries, which may bring forth the export of Chinese

equipment, machinery, building materials, technology, and labor services.

The Loan is also applicable to Chinese contractors who win the tender in

the international bidding on the projects financed by the World Bank,

Asian Development Bank, and other international financial organizations.

Prospective Borrowers

Prospective borrowers of the Loan include Chinese enterprises that are

| Registered with the regional Administration of Industry and Commerce

and its local offices;

| Accredited with independent legal person status;

| Authorized to handle contract construction abroad; and

| Qualified with expertise, professionals and technology for such

operations. |

| | |

Qualifications for Loan Application

1. The borrower should demonstrate fine management and operations, have a

sound financial position and a favorable credit standing, and should be

capable of repaying the principal and interest incurred;

2. The borrower has already signed a contract for undertaking overseas

construction projects, which, when necessary, should be accompanied with

authorization and approval by competent government authorities;

3. The spin-off exports of Chinese equipment, materials, technology, labor

service, and management services that derive from overseas construction

contracts should account for no less than 15% of the total value of a

specific project contracted;

4. The value of the overseas construction contract should be no less than

USD 1 million, with advance payment amounting to no less than 15% of the

total contract value in principle. In the case of deferred repayment, a

payment guarantee should be provided as acceptable to the Bank;

5. The overseas construction contract shall be expected to offer

satisfactory economic returns;

6. The contractor should have license and capability to perform the deal

sealed;

7. The host country should remain stable both politically and

economically;

8. In the case where repayment is assessed highly risky, appropriate

export credit insurance should be arranged as per the requirements of the

Bank;

9. Repayment guarantee acceptable to the Bank should be provided; and

10. Other requirement that the Bank deems to be of necessity.

Documents and Materials required for Loan Application

Documents and materials required for applying to the Bank for the Loan

include:

1. Loan application;

2. The contract for the construction project and authorization and or

approval by competent government authorities, if required;

3. Purchase contract and other commercial contracts related to the

construction project;

4. Analysis of economic returns and the cash flow statement of the

construction project that the borrower has signed to undertake;

5. A letter of intent for covering export credit insurance if such shall

be deemed necessary;

6. The borrower's license for undertaking construction projects overseas,

profile statements of both the borrower and the guarantor, a copy of the

business license of the borrower having passed the annual examination,

audited financial statements of the past three years and audited financial

statements of the recent period of the current year, and other documents

that demonstrate the credit standings and the operations of both the

borrower and the guarantor;

7. Letter of intent for repayment guarantee, or in case of mortgage or

pledge, valid certificates of ownership of the property under mortgage or

pledge and evaluation reports thereof; and

8. Other relevant documents demanded by the Bank.

|

|

Export Buyer's Credit

|

|

|

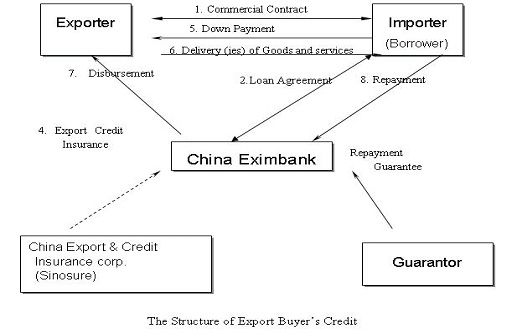

The Export Buyer's Credit refers to the medium and long-term credit

offered by the Bank to creditworthy foreign borrowers to support the

export of Chinese capital goods, services and overseas construction

projects. With a competitive interest rate and a longer period of time,

the Export Buyer's Credit can facilitate foreign importers to make prompt

payment to Chinese exporters for the exported products and services. The

operations generally follow the Arrangement on Guidelines for Officially

Supported Export Credits as developed by OECD.

1.Products and Services Covered by the Credit

Export Buyer's Credit is mainly extended to finance the export of Chinese

capital goods such as mechanic and electronic products and complete sets

of equipment. It is also available for financing the export of

Chinese-built ships, high- and new-tech products & services, and

overseas construction projects contracted by Chinese companies.

2.Requirements for Application

| The Borrower

The borrower should be a foreign importer, or the importer's bank,

or Ministry of Finance of or other authorized government institutions

of the importing country, and should be acknowledged by China Eximbank.

The borrower should have reliable credit standing, and should be

capable of repaying all the principals and paying the accrued

interests and related fees and charges of the loan as prescribed in

the agreed repayment schedule.

| The Exporter

The exporter should be an independent legal entity with the

acceptable qualification of dealing export operations or overseas

projects as verified by authorized Chinese government authorities, and

should be capable of implementing the commercial contract. The goods

and services exported should fall within the support list of Export

Buyer's Credit operated by China Eximbank.

| Commercial Contract

The commercial contract that seeks for export buyer's credit should

be examined and approved by the Bank, and should satisfy the following

requirements:

| The value of the commercial contract should be more than USD 2

million.

| The portion of the Chinese content of exported goods should be

no less than 50% of the total value.

| The cash payment (down payment) made by the importer to the

Chinese exporter should not be less than 15% of the total contract

value or 20% in the case of ship export contract. |

| |

The requirement of the Chinese content portion and the down payment

percentage on overseas construction projects should be consistent with

relevant policies and guidelines set by the Chinese government.

Subject to the credit policy of the Bank, the borrower is required

to provide a repayment guarantee, and when necessary, a sovereign

guarantee of the importing country should be provided.

Whether it is necessary to apply for export credit insurance should

be decided by the Bank in accordance with the country risk of the

borrower.

3.Credit Terms and Condition

| Loan Currency

The currency of the loan could be either US Dollar or other

currencies acceptable to China Eximbank.

| Loan Amount

Generally, the Export Buyer's Credit provided by the Bank for an

export project of goods or services shall not exceed 85% of the total

contract value, and 80% in the case of a ship export contract. As for

an overseas contracting project, the loan amount should follow the

regulations of state relevant policies.

| Maturity Period

The maximum maturity period is 15 years from the date of the first

disbursement of the loan to the last repayment date as stipulated in

the loan agreement.

| Interest Rate

The interest rate could be either a fixed interest rate on the

basis of the Commercial Interest Reference Rate (CIRR) as monthly

announced by OECD, or a floating interest rate on the basis of London

Interbank offered Rate (LIBOR) plus a certain interest rate spread.

For special cases, the interest rate could be negotiated and decided

between the lender and the borrower.

| Drawdown of the Loan

The availability of drawdown under the loan agreement shall be

consistent with the terms and conditions of the commercial contract

related.

| Fees & Charges

The borrower shall pay management fees, commitment fees and

exposure fees to China Eximbank.

| Loan Application and Approval

An eligible borrower should submit a formal application to China

Eximbank for Export Buyer's Credit together with the following

documents and materials:

| Draft commercial contract or letter of intention, Tendering and

bidding documents, feasibility study report on the project and

relevant approval documents;

| Documentation that proves the credit standing of the borrower,

the guarantor, the importer and the exporter; the financial

statements of the borrower and the guarantor;

| Other documents and materials required by the Bank. |

| |

China Eximbank will examine the application documents submitted by

the borrower, confirm the qualification of the borrower and the

guarantor, decide credit terms and conditions, and start project

appraisal and approval process. Upon approval of the loan, China

Eximbank will sign with the borrower a loan agreement on Export

Buyer's Credit, and the guarantor will present to the Bank a Repayment

Letter of Guarantee.

| Loan Disbursement and Repayment

China Eximbank shall disburse the loan to the borrower as

prescribed in the loan agreement.

The borrower shall repay to the Bank the principal and pay the

interests together with relevant fees of the loan as stipulated in the

loan agreement. Unless otherwise specified, once the drawdown period

is over, the principal of the loan should be repaid semi-annually in

equal installments. The interests incurred should be either paid

semi-annually as calculated on the basis of the loan outstanding or

follow the terms stipulated in the loan agreement.

| Working Procedures

1. A commercial contract is signed

between the exporter and the importer. The value of the contract

should be no less than USD 2 million.

2. A loan agreement is signed between China Eximbank and the borrower.

The loan amount should not exceed 85% of the commercial contract value

while 80% in the case of a ship export project.

3. Repayment guarantee provided by the guarantor to China Eximbank may

be required according to the project case by case.

4. Whether to require export credit insurance or not shall be

determined by China Eximbank according to the country risk of the

importing country.

5. The down payment should not be lower than 15% of the commercial

contract value and no less than 20% for a ship export project.

6. The exporter delivers goods to the importer as stipulated in the

commercial contract.

7. China Eximbank disburses the loan after the delivery of the goods.

8. The borrower shall semi-annually repay to China Eximbank the

principal, the interests and all the fees and charges of the loan in

accordance with the provisions of the loan agreement

|

| | | | | | | | | | |

|

| |

|